Everyone whose livelihood depends on the oil industry is, has one question on their mind, have the oil markets hit bottom?

The answer is yes, but first let me share why that narrative is important; then I will outline why I think we have hit bottom.

Once oil company executive psychology shifts from we are still falling to we have finally hit the pavement, they can start executing recovery plans versus continuing triage. This translates into less layoffs and more shoring up of resources (i.e. retention and hiring) to catch the next wave of increasing oil prices.

Fortunately, many oil executives have demonstrated great restraint by not laying off hundreds of thousands of employees like they did back in 2014; when we had our last oil price crash.

Over 500,000 people were laid off from the Oil & Gas industry; it was as brutal a downturn as they get.

Presently, there have been furloughs, reductions in pay and a projected 100,000+ layoffs, but nothing near the multiple hundreds of thousands people cleared off the books in 2014.

What is different now than in 2014?

Part of it is oil company leaders being sensitive to not just depressed oil prices, but also the larger economic contraction due to Covid-19.

Also, oil companies run much leaner now than they did pre-2014.

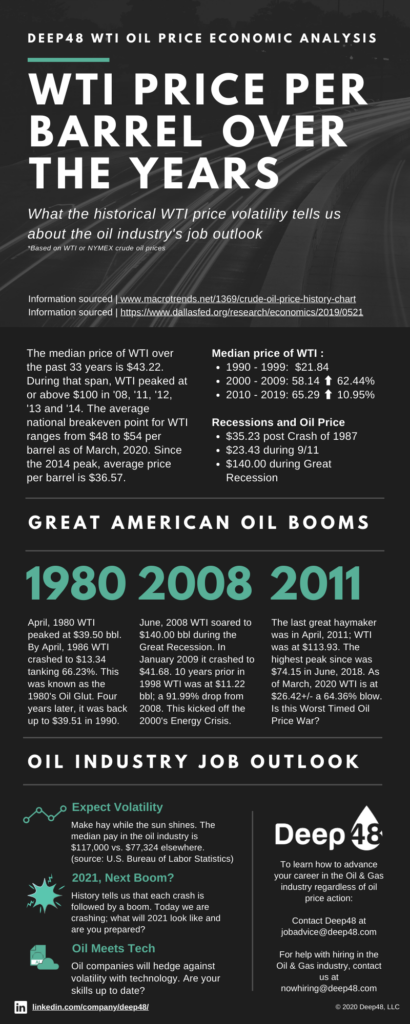

In 2014, oil was coming off all time highs; prices never before seen in the $130 – $160 per barrel range. At those astronomical prices, it could only go down from there and when it did crash it wiped out the bloat the industry took on to produce as much oil at a price we may never see again.

It can be argued that the Saudis triggered the 2014 crash in order to squeeze out U.S. shale producers.

However as American ingenuity prevailed, U.S. shale producers figured out how to produce oil at $30+ / barrel.

This lead to the U.S. blasting into the front of the global oil production line.

But, before the U.S. claimed the title of world’s top oil producer, Russia and OPEC struck a deal in 2016 to curb production. This stabilized the market and paved the way for the United States to freely produce massive amounts of oil from U.S. shale plays; while Russia and OPEC had one hand tied.

Fast forward to 2020 and that deal from 2016 was set to expire on April 1st, 2020. This time, it was Russia who was unhappy with losing to the U.S. in oil production so they refused to honor continuation of cuts beyond April. In response, Saudi declared they too would then produce as much oil as they wanted without a deal; the rest of OPEC got in line leading to a massive oversupply; exacerbated by Covid-19’s job on global demand.

It was really the perfect storm but its a rational storm. The causes make sense and oil didn’t fall from absurd price levels like in 2014. Therefore the road back to $50 – $70 per barrel isn’t as steep of a climb.

Back in 2014, the industry was severely bloated from a full plate of oil at $160 per barrel. In 2020, companies were still running fairly lean because of the lessons learned on the dangers of bloat back in 2014.

However, what lessened the blow from the 2014 crash is that laid off oil workers had the opportunity to pivot to other industries. This was a metric Deep48 tracked and found that many oil workers moved into shipping & logistics, non-oil equipment manufacturing and defense & aerospace.

Today that option is not available as all other industries are just as battered as Oil & Gas.

The other reason for companies not laying off is because they know this is a temporary bust; we will eventually get on the other side of Covid-19 and Russia and OPEC can’t depress prices in perpetuity; so the logical conclusion most companies seemed to have made is that laying off thousands of workers only to hire them back a few months later will be far too costly.

Enter President Trump:

Just spoke to my friend MBS (Crown Prince) of Saudi Arabia, who spoke with President Putin of Russia, & I expect & hope that they will be cutting back approximately 10 Million Barrels, and maybe substantially more which, if it happens, will be GREAT for the oil & gas industry!

— Donald J. Trump (@realDonaldTrump) April 2, 2020

With this simple tweet, oil prices rallied over 20%; although they are still down significantly from their recent highs, the U.S. response is what the markets needed in order to get their bearings on which direction the market will go.

With this simple tweet, oil prices rallied over 20%; although they are still down significantly from their recent highs, the U.S. response is what the markets needed in order to get their bearings on which direction the market will go.

A case for bottom.

There are four parts to this oil market collapse. Covid-19, Russia, OPEC+ and the United States.

It will be a long while before the reduction in demand that Covid-19 has caused will be restored. But the first defensive response to the oil war was President Trumps proclamation that Saudi and Russia have agreed to consider a reduction in production.

Once OPEC and Russia confirm this is indeed their intention and act on it, then we can expect oil to recover well into breakeven territory fairly quickly. Then as Covid-19 eases its grip on the world, oil prices will slowly recover. Granted a full recovery could take a couple of years due to the amount of cheap oil markets have been flooded with; essentially tapping out storage capacity that needs to be consumed before additional supply at higher prices can be restocked.

However, I think we can all agree a slow recovery is certainly preferred over a prolonged downturn.

If for some reason, Russia and OPEC can’t come to an agreement oil will tank again; this time harder than what we have seen so far. At that point President Trump has indicated he’d be willing to put tariffs on oil imports. This essentially shuts out foreign oil for US refiners; forcing us to export less and use more of our homegrown stock.

Per the EIA, we produce about 12+ mmb/d and consume about 20+ mmb/d. The difference between petroleum consumption and production is mainly composed of net imports (imports minus exports) of petroleum and changes in petroleum inventories. (source)

So where does this leave us today? Now that there is a thaw in the war between Russia and OPEC coupled with U.S. intervention in their oil war; the worse could be behind us. If they keep chipping away at one another, then we may just sit on the sidelines and shore up our shale companies by nationalizing our production.

The next couple of days are expected be choppy until Russia and OPEC who meet on Thursday April 9th. The result of that meeting will determine what scenario plays out. We will either see oil rise above $30 per barrel or drop into the teens. If they get their act together then and Covid-19 finally gets under control, we should be off to the races.